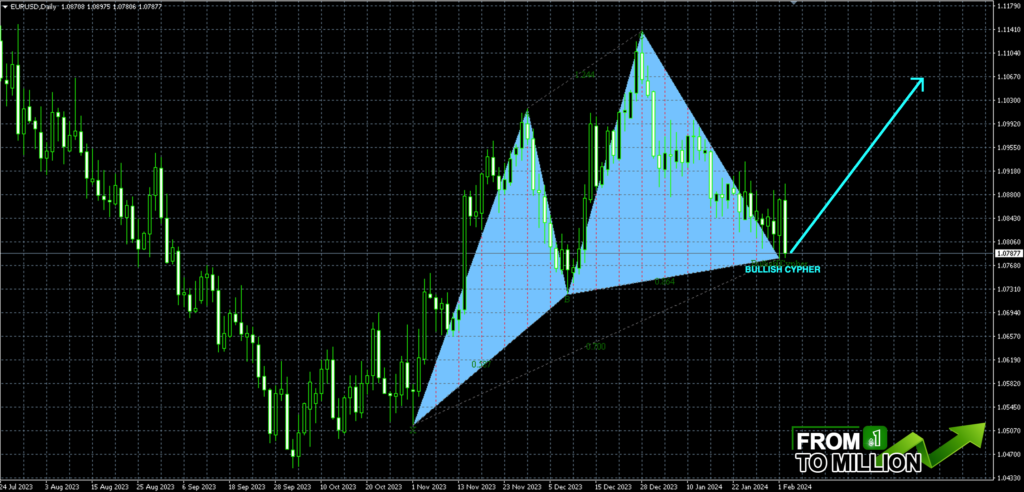

USD has made a few attempts to stay above 100 and failed every time so far. But it never also dropped much below the level, hovering around 98, which makes me more and more bullish as time goes on. Even though Trump is creating massive pressure on the Dollar with his rhetoric against Powell and FED in general, the market is getting used to that and takes it less seriously with every speech. Eventually Europe’s problems should bring Euro down and the Dollar should gain some bullish momentum. This week we have a PM confidence vote in France, where he will most likely fail and it will create some short-term instability. And we have ECB on thursday, which won’t be much hawkish for EU either, I suppose. So the longer USD keeps hovering below 100, the higher the chances of a bullish run. Timing is everything in this case.