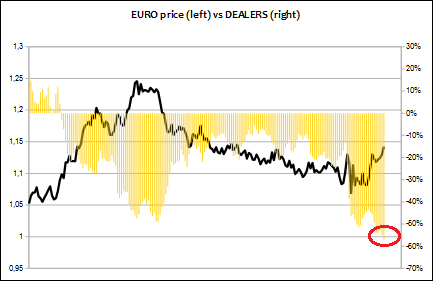

They don’t want to give up, but eventually they will have to…last week might have been their last effort to go close to 1.15. There will be either a reversal soon or just a correction, if bulls want to keep pushing this up. The correction might go as far as 1180-1220, if it breaks below, its a reversal then. Now lets look at the COT data, banks(dealers) are now more short than they were when EURUSD was at 1.25, just think about that for a second…:)

Of course, banks can withstand more drawdown than us retailers can…for them 100-200 pips doesn’t matter much, but we are at a zone which would be very dangerous to long, so short is the only way to look right now, even if just for a correction, as I mentioned above.

Asset managers(hedge funds, etc) are on the opposite side, heavily long…and its not good to follow them, because they are very often wrong. If you look at the chart below, when EU was at 1.25, they were heavily buying, while banks were heavily selling. Just think about it next time when you want a fund to manage your money. Anyone seen Wolf of Wall Street? 🙂

Now look at all this from the EURUSD perspective. Better to take it slow this week and set small and realistic targets. So from looking at the H1 chart, we have a clear triple top, so 1370-80 would be the first area to look for when being short.

If this area breaks is yet to see, but if this does, we can move towards target number 2, on the H4 chart. Target 2 is 1280-1305, which was a strong support zone before last week’s upmove. Beyond that we probably don’t need to look this coming week, but we never know…all I know is not to go long at any of these levels, other than for a scalp. Long and hold, no thanks.

There might be another good opportunity at EURGBP this week, to start building medium term positions for a 400 pip downmove, with a SL above 9200. But the SL is still 100 pips away, so better to watch and evaluate during the week first. EG can be unpredictable short term.

Good luck to everyone next week!