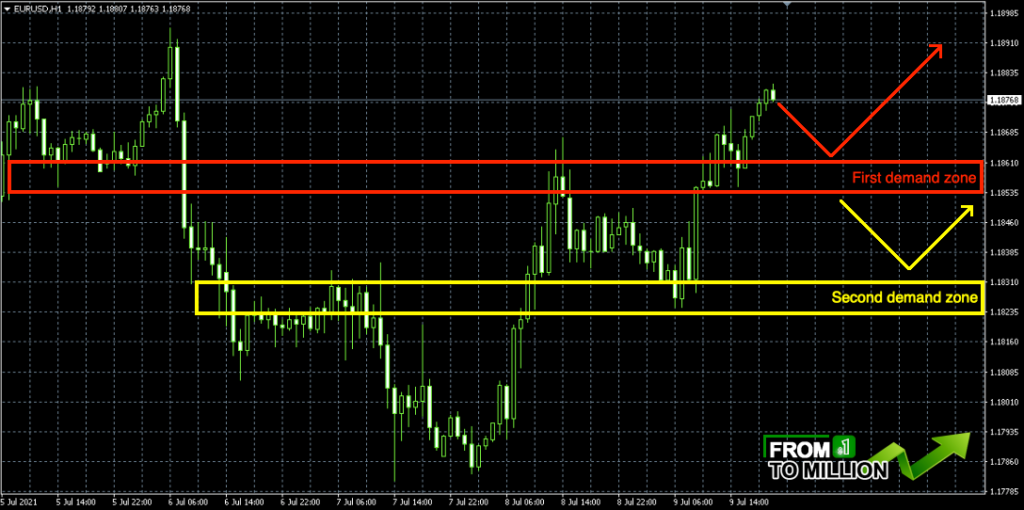

Apart from EU, all other pairs worked out very well this week. UJ and UCHF dropped hard…GU printed a strong bullish candle, too, only euro was not as strong compared to other currencies against the dollar. But that can easily change next week…and EU can make up for this week with a re-test of 1970-80 next week. Easiest trade of the week might be EG, as it is back below 8550, which is a strong demand zone. EU bottomed nicely during London on friday and then created a new support zone above 1850 during NY. This zone should be re-tested next week and if bulls can stay above it, then a break of 1880 upwards is inevitable. As for GU, its NY support zone was 3825-35, created during London fix, which makes it significant. So, if both pairs would re-test their newly created support zones, EG would go up towards 8580-8600, at least. So early next week I expect EU and GU to be bearish, to re-test their support areas, where they should turn back to bullish. But EG still remains the easiest trade into next week, as GU’s bull move on friday was fairly overstreched, so the correction should help EG to attack the 8600 area again. Medium to long term, I am bullish on EG into 8700 and possibly more, so buying the dips is not a bad idea either way.

From a fundamental standpoint, USD might be in trouble due to a debt ceiling deadline. Long story short, the US is out of money to spend…with a weekly spending around 50 billion and 400 billions left to spend…its only a matter of weeks until the money runs out, if the debt ceiling isn’t increased. And this happening during summer holidays doesn’t make it easier to solve. As we know, politicians are hard working individuals, who need to work many minutes every week, so they need to take a break over the summer, to gain new strength, because nobody suffers as much as them. Of course they will make a deal in the end, otherwise government would need to shut down again for a while, like it did in the past already. And once more money can be borrowed, more money will need to be printed again…which will increase the inflation and devaluates the dollar for a while. I would like to see the USDx to re-test the 90 area again…to see if it manages to stay above, despite all the printing…and if it does, then start buying it again. But its too early to buy now, above 92.