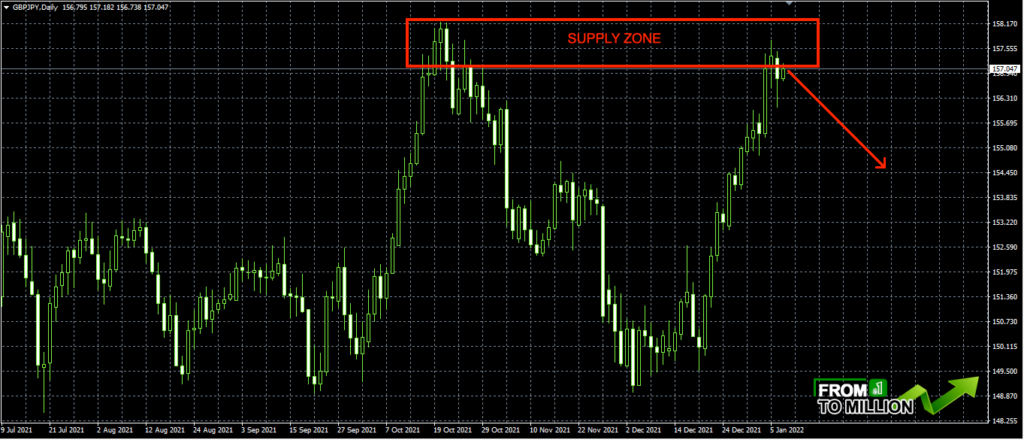

Past few weeks have been slow on the EURO chart, it has been heavily accumulating during the holidays and looks like its about to break upwards soon. But the current range might hold early next week, as I expect some correction of friday’s NFP move. The question is where it stops and if it finds some new strong support above the previous ones around 1300. But even if we see one more major drop below 1300, I am staying on the bullish side and buying the dips, the lower it gets, the better. GU might help this move a bit, since its somehow overstreched and should correct towards 3500 or even possibly towards 3300. Its at an important level, if you check the daily chart below. It will break upwards eventually, but it might not be right away…3600 might provide some resistance for now. The pair that finally started the downmove is UJ, which is in a good “sell the spikes” mode. So if it manages to climb towards 116.00 next week or even higher, its another good short opportunity…my first bearish TP is below 114.00. Looking at UJ bearishness and GU below a strong resistance, might make GJ the best pair to pick to short. Its at a strong supply zone…so placing a SL above this zone gives a good risk to reward ratio. Once GJ starts a direction, hundreds of pips come quick…but of course the risk with this pair is also the highest, so trade it with caution.