This week was going according to my plan first, ranging between 1840-1900 and I was waiting if 1908 breaks to the upside, but bulls didn’t have enough power to do it, they barely managed to touch 1900. On thursday and early friday I saw a nice long setup before NFP, market was expecting bad numbers, obviously and preparing for a spike up from 1800. But the numbers were surprisingly “green” and we saw a further drop. But there is no reason to panic for bulls…the old support at 1750 did hold and week closed above 1760. Beyond this support, there is another big one around 1700, which is not too far. This area is a big demand zone for bulls and I think we will see them coming back to life next week. 1830 will need to be re-tested, anyway, no matter if EU is bearish or not. Possibly 1850+, too…and thats when the game might change and bulls could do what nobody expects at this moment…to break 1908 and create a strongly bullish pattern. Monday will give us a clue as how high bulls can bring it during the first correction up and then what London and NY do with it. It will be an important day to follow through all sessions, from Tokyo into London and NY. If bears get exhausted, bulls should take over during the week, with a bullish weekly close. The risk to reward ratio is better for longs at the moment, as a major support is only about 60 pips away, another one is only 10-20 pips away and bull targets can be 100 pips away and more.

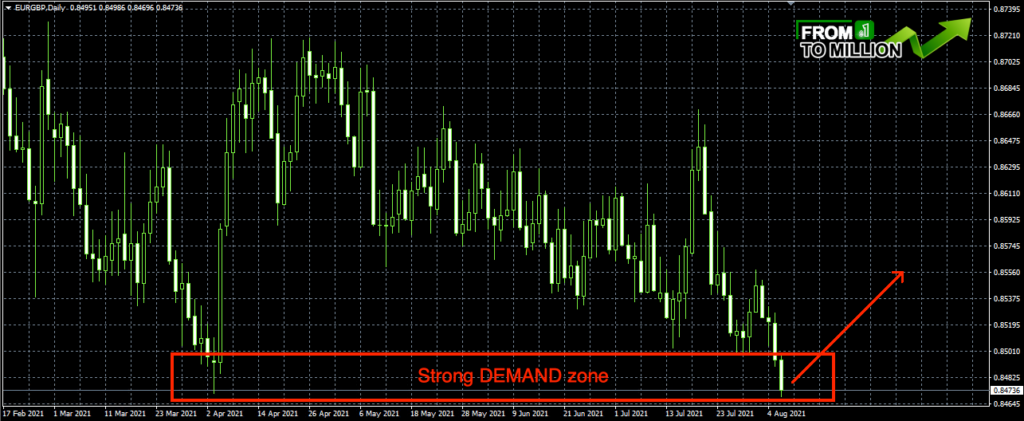

When it comes to GU, all the demand zones are below the weekly close…the nearest one is between 3750-3800, which is 100 pips way from friday’s close…so if I was going to buy GU, I would rather wait if it keeps dropping and how far it drops. EG is at a big demand zone and can easily spike above 8500, towards 8600 even…so even if GU dropped 100 pips, it might not affect EU that much. If the current area holds for EG, it should be good for buying the dips through the week.